Given the robust connections between financialization and inequality, and the relatively small number of good jobs created by the financial sector, it’s unclear whether the departure of the industry would be a net negative for the city. financial exchanges are based in Chicago, including the Chicago Board Options Exchange and the Chicago Mercantile Exchange.Ĭritics of the proposed financial transaction tax say that it could drive some financial firms out of Chicago. Vallas has additionally received donations from executives at Calamos Investments, the Chicago Trading Company, Cognitive Capital, Consolidated Trading, and DRW - firms that also profit from speculative trades. Johnson is a former social studies teacher endorsed by the Chicago Teachers Union, which has denounced Griffin’s past interventions in local politics and support for mass school closings. Ten Citadel executives have contributed a total of $762,000 to Vallas, a former Chicago Public Schools chief who helped Wall Street firms extract more than $1 billion in additional interest payments from the school district during his tenure, as The Lever reported last week. Griffin is on record opposing the idea, claiming during a 2021 congressional hearing that a national financial transaction tax would “injure Americans hoping to save for retirement.” Johnson’s financial transaction tax plan mirrors those proposed by progressives at the state and federal levels. Bruce Rauner.Įarlier this month, Griffin endorsed Vallas, telling Bloomberg News, “I really admire my colleagues who have supported Paul Vallas publicly with their voice and with their money.” has been a major funder of right-wing politicians like Florida Gov. Citadel’s billionaire founder and CEO Ken Griffin, Jr. That’s nearly 10 percent of Vallas’ total mayoral fundraising haul.Īmong the firms that profit from speculative trading is the hedge fund giant Citadel, whose financial dealings were swept up in the 2021 Gamestop controversy. Executives at six such firms have contributed $1.6 million to Vallas' bid, according to a Lever review of campaign finance records. Johnson’s tax proposal would hit financial firms that profit from speculative trades, often conducted at the millisecond level. Vallas opposed Johnson’s tax plan during a debate last week, arguing that raising taxes “is the absolute wrong approach to take,” and that Chicago’s next mayor should instead focus on reducing spending. Johnson’s campaign estimates this financial transaction tax could raise as much as $100 million annually for the city.

The revenue plan proposed by Cook County Commissioner Brandon Johnson includes what he calls a “Big Banks Securities and Speculation Tax,” which would levy a $1 or $2 charge on most trades. The same applies to each quarter thereafter.In the final stretch of Chicago’s closely watched mayoral race, candidate Paul Vallas is attacking his progressive opponent’s plan to fund public schools and infrastructure by taxing the wealthy - including a tax on financial trading that would hit some of Vallas’ top campaign donors. If payments are received after February 10th, interest is retroactive to the original due date of February 1st as per New Jersey Statute 54:4-66.

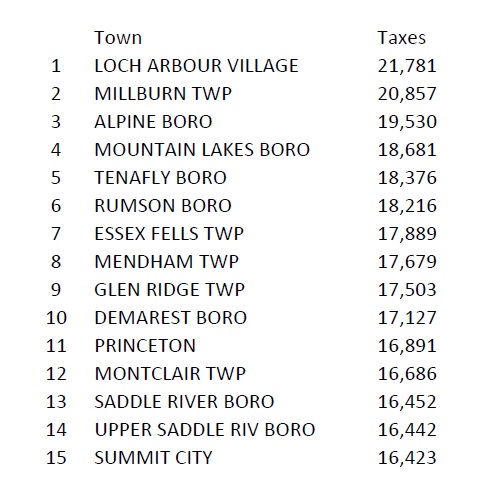

The grace period is through February 10th. Taxes are due : February 1, May 1, August 1, and November 1.Ī ten-day grace period to the 10th of the month is allowed by resolution of the Mayor and Council after which interest is charged from the first day of the month in which payments are due. For example, the first quarter taxes are due on February 1st. The Office of the Tax Collector bills over 3,100 taxpayers and collects taxes quarterly. The Tax Collector is charged with the responsibility for receiving and collecting all taxes and assessments both current and delinquent. The Chief Financial Officer oversees the financial operations of the Borough.

Financial transaction tax new jersey full#

This department keeps a full account of all cash receipts and disbursements of the Borough, has custody of all investments and invested funds of the Borough in a fiduciary capacity, keeps all money not required for current operations safely invested or deposited in interest-bearing accounts, handles the payroll for municipal employees, processes requisitions and purchase orders for payment and collects current and delinquent taxes. The Finance Department is responsible for all financial transactions relating to the revenues and disbursements of the Borough.

0 kommentar(er)

0 kommentar(er)